dekalb county tax assessor gis

Gwinnett gwinnett co tax assessors stewart oliver chief appr 75 langley drive lawrenceville ga 30046. Register My Vehicle.

Regional Office of Education.

. Pay property taxes view property tax and assessment details. Request a Property Tax Bill. You must bring your driver license or utility bill to sign up for this exemption.

DeKalb County residents can sign up to receive Property Tax statements by email. DeKalb Tax Commissioner. Under the leadership of Tom Scott deceased and his successor Claudia Lawson Mr.

Contact Your Township Assessor. It is a privilege to serve you. Search for the property record and click the link underneath the Pay Now button.

The Property Appraisal Assessment Department is responsible for the annual valuation of all taxable real and personal property in DeKalb County and producing a timely equitable and acceptable tax digest for DeKalb County that meets all. Local government GIS for the web. You may also contact the Property Appraisal office at 404 371.

DeKalb County Property Appraisal. Monday-Friday 800 am to 430 pm 109 W Main St PO Box 77 Maysville MO 64469. DeKalb Assessor 815 895-7120.

DeKalb County Government 200 North Main Street Sycamore. For more information about property tax bills. Dekalb County Assessor 109 W Main St PO Box 77 Maysville MO 64469 Voice.

Johnson has held several positions within the tax office including supervisor and manager level positions over the past 21. DeKalb County Tax Commissioner. You can visit their website for more information regarding property appraisal in DeKalb County.

Although multiple criteria can be entered to narrow your search results you are not required to complete each criteria. Fulton county board of assessors dwight robinson chief appr 235 peachtree street ne suite 1400 atlanta ga 30303. Baxley ga 31513 912-367-8109 fax.

And members Robert A. The DeKalb County Board of Assessors is the agency charged with the responsibility of establishing the fair market value of property for ad valorem taxation purposes. File for Homestead Exemption.

Make An Online Payment. View property map street map land use sales tax assessment zoning voting information. DeKalb County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in DeKalb County Alabama.

For additional information you may call the Revenue Commissioners Office at 256 845-8515 between the hours of 800 am. The services provided by the mapping department of the DeKalb County Revenue Commissioners Office are a function of real property appraisal. Burroughs Charlene Fang John W.

You can search for it. WEDGE Property Tax Data. DeKalb County Public Records.

Search land record documents on file at the Recorders Office. If you do not have these notices readily available you may also find it using our Assessment Property Tax Search. I sincerely hope that you will find it both helpful and informative.

FOIA -Freedom of Information Request. Property ownership maps are created and updated by the mapping department to provide current maps depicting the location size and ownership of tax parcels according to Alabama Department of Revenue specifications. Information Management Office GIS.

Chief County Assessment Officer. Johnson joined the DeKalb County Tax Commissioners Office in July 2000 as a Network Coordinator. The Property Index Number PIN required by the State of Illinois for Illinois Department of Revenue Form IL-1040 is the same as your Parcel Number on your tax bill or on your Assessment Change Notice.

In order to achieve this goal the Chief County Assessment Office serves the resident taxpayers of DeKalb County with assessing their property value in accordance with the Property Tax Code 35ILCS200. The amount is 400000 assessed value on state and 200000 assessed value on county. Lawson and Secretary Calvin C.

WEdge -DeKalb County Property Tax Inquiry and Property Tax Payments. DeKalb GIS requires owners acknowledgement block signature line for each owner of any boundary line. Presently the members of the Board are Chair.

View Property Tax Information. Compass DeKalb County Online Map Search. 2 DeKalb GIS requires that all re-parcel boundary line adjustments map changes must display all owner name s on the coversheet as per DeKalb Tax Records.

Pay property taxes view property tax and assessment details. DeKalb Tax Commissioner. The regular homestead exemption is for taxpayers under 65 years old and applies to State and County Single-family owner-occupied property.

1 DeKalb GIS requires that all parcels involved in the map change must have matching verbatim ownership.

Deadlines Due Dates Newton County Tax Commissioner

Property Tax Dekalb Tax Commissioner

Dekalb County Tax Commissioner S Office 4380 Memorial Dr

Richmond County Tax Commissioner S Office Facebook

City Of Thomaston Ga Historical Building In Downtown Thomaston Georgia Was Cotton Warehouse Historic Buildings Thomaston Property Records

Things You Should Know Before You File An Appeal With The Dekalb County Tax Assessor

Extension Matters Volume 4 Number 3 How Corn Rows Grow Cornrows The Row Extensions

Property Tax Dekalb Tax Commissioner

Georgia Map Images Stock Photos Vectors Shutterstock

Dekalb County Ga Property Tax Calculator Smartasset

Dekalb County Property Appraisal

Click2skip Dekalb Tax Commissioner

How To Know When To Appeal Your Property Tax Assessment Bankrate

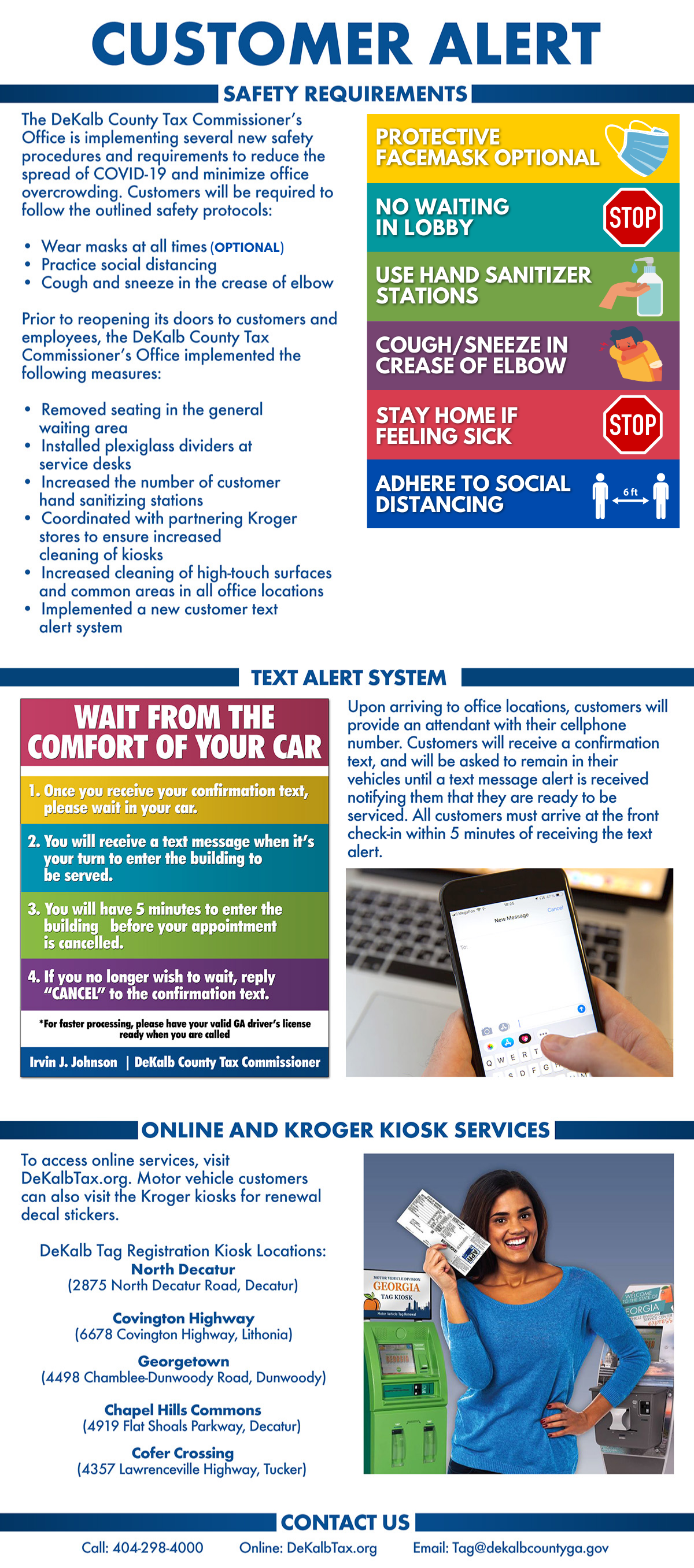

Covid 19 Customer Alert Dekalb Tax Commissioner